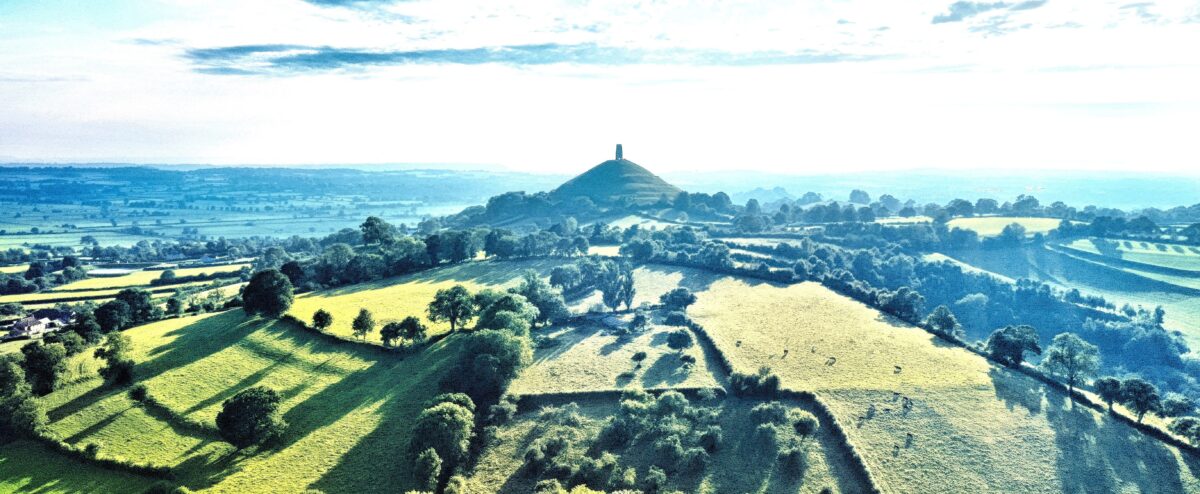

Established in 1969, Burton Sweet has offices across the South West.

Going beyond the numbers, we want to play our part in the local community, acting for business owners, individuals, trustees, executors, and charitable organisations, supporting them at every stage of their journey.

How do we work?

Burton Sweet believe in employee development, ensuring our team of chartered and certified accountants are up-to-date with the latest regulations and methods. The depth and diversity of skillsets available means that our firm has a wealth of practical experience to find tailored solutions to your needs.

Supportive services

Whilst technical knowledge is invaluable, at Burton Sweet we know that offering support and being the first point of contact for our clients is vital. We want to be the friendly voice on the phone or the welcoming face in the office, so you feel assured that your heading in the right direction.

Have a look around our website and get in touch if you have any questions, or are interested in the services we provide…