Certain businesses must pay Corporation Tax to HMRC on their profits over the course of an accounting period (annually).

This applies to…

- Limited companies

- Foreign organisations who trade in the UK

- Members clubs, societies and associations

- Housing associations

- Trading groups of individuals (cooperatives)

Generally, charities and not-for-profit organisations are exempt from Corporation Tax, but only when their income is used for charitable purposes.

Sole traders and partnerships don’t pay Corporation Tax but must pay tax on their income via self-assessment.

When does Corporation Tax apply & how much should you pay?

Corporation Tax must be paid on trading profits, investments, and selling assets for more than they cost (chargeable gains).

Currently, the tax rates for Corporation Tax are…

Small profits rate – Profit £0 – £50,000 – 19%

Main rate – Profit over £250,000 – 25%

If a business makes profits between £50,000 and £250,000, marginal relief provides a gradual increase in the Corporation Tax due, so there isn’t a big jump in rate.

Should a business make a loss over the course an accounting period, they should notify HMRC promptly. A tax return must still be completed, even if this is the case.

Paying Corporation Tax

It’s the responsibility of the director(s) to ensure that the Corporation Tax return has been submitted on time, and the tax bill has been paid, even if the business employs an accountant.

A CT600 tax return is required for each twelve-month accounting period. This is often the same as the company’s financial period for which accounts are prepared. However, if the financial period is more than a year (due to a change of financial year-end or in the first period after incorporation) then more than one CT600 will be required.

The statutory filing date is either 12 months after the accounting period, or three months after a notice to deliver a return from HMRC is received, whichever is latest.

Companies that have only just been incorporated, must inform HMRC within three months of trading. Register online by creating a Government Gateway account for the company using the ten-digit Unique Taxpayer Reference. This should be sent to the company registered address within a few weeks of registration with Companies House.

The Corporation Tax return filing deadline and the payment deadline are different. The deadline for companies that make taxable profits of up to 1.5 million is 9 months and one day after the accounting period ends.

Companies that make taxable profits over £1.5 million must pay the tax liability in quarterly instalments.

Penalties & charges

HMRC can fine businesses for late submission of returns and tax payments or providing inaccurate information. Interest will be charged on tax paid late, as well as possible penalties or surcharges.

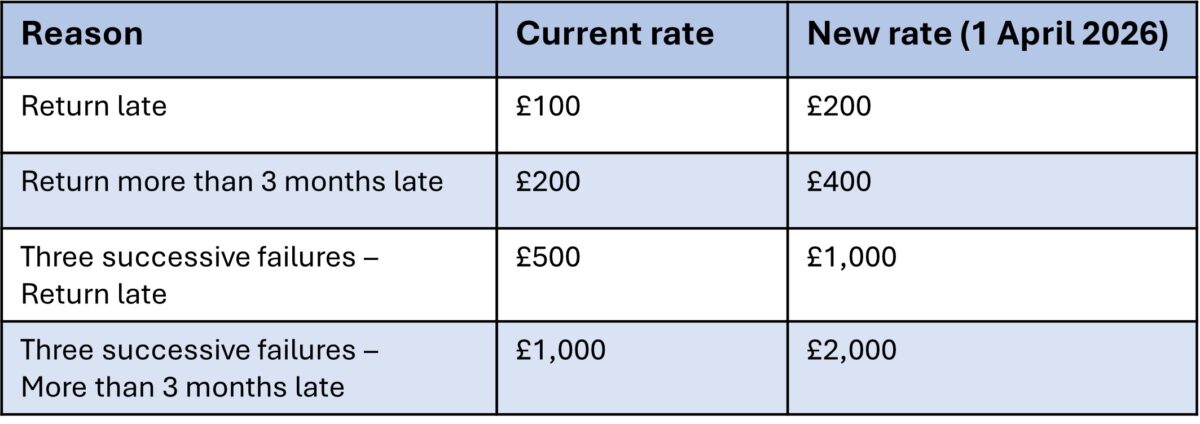

In the Autumn Budget 2025, the government announced that penalties for late Corporation Tax returns will double from 1 April 2026. Here are the current and upcoming charges…

Reducing your Corporation Tax bill

Unlike individuals, companies don’t receive a tax-free allowance; all profits are taxable. However, there are a number of expenses and deductions you might claim to reduce your liability.

You could choose to pay yourself a salary, which is a tax-deductible expense for a business. However, this will affect your own personal Income Tax, so you will need to decide if this is the most sensible option for you financially. It might be most effective to take a combination of salary and dividends, avoiding the higher personal tax bracket and capitalising on the dividend tax-free allowance.

Pay employer contributions into your pension from your business. These are allowable expenses for Corporation Tax.

Should your business pay its Corporation Tax before the deadline, HMRC will pay you 0.5% interest on the amount paid.

Be organised; stay informed

First and foremost, keep accurate records of your earnings and expenses, so you can complete your Corporation Tax return correctly and maximise the reliefs you can claim. Stay informed on what expenses and deductions are available. This will allow you to estimate your liability ahead of time, so you can budget appropriately.

Note the filing and payment deadlines in your calendar and set reminders leading up to these.

It can be useful to employ an accountant to ensure all the details are correctly managed and you are minimising your liability. If you would like some guidance and assistance with managing the relevant financial data, completing your Corporation Tax return, and paying your bill, please contact with us and a member of our team will be happy to help.