If you had a student loan and have finished your studies and entered the workforce you must begin to make loan repayments from the April after you have finished your studies or when your income begins to exceed the annual threshold. The annual

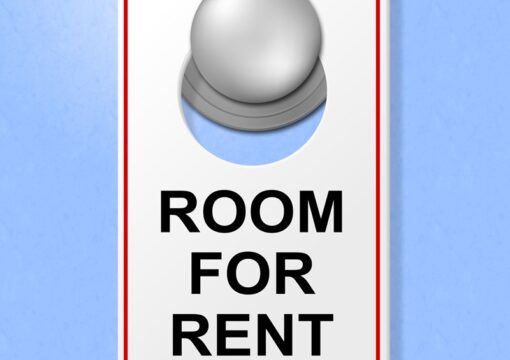

The Let Property Campaign provides landlords who have undeclared income from residential property lettings in the UK or abroad with an opportunity to regularise their affairs by disclosing any outstanding liabilities whether due to misunderstanding

The R40 form Claim for repayment of tax deducted from savings and investments is available on the GOV.UK website. Individuals who have paid too much tax on interest can use the R40 form to claim back any overpaid tax. The form and associated guidance

If you are entitled to the marriage allowance and have not yet applied, you could receive a payment of up to £1,150 from HMRC. HMRC used the occasion of Valentine’s Day to remind couples to make a claim. It is estimated that whilst 1.78

There are tax implications that you will need to consider if you previously left the UK to live abroad and are now returning to live and work in the UK or are considering such a move.

In most cases, if you have returned to live in the UK, you will

Are you among the over 958,000 taxpayers that missed the 31 January 2020 filing deadline for 2018-19 Self-Assessment returns? If you missed the filing deadline you will be charged a £100 fixed penalty if your return is up to 3 months late,

The High Income Child Benefit tax charge could apply to you or your partner if either of your individual taxable earnings exceeds £50,000 and you are in receipt of child benefit. The charge effectively claws back the financial benefit of

You can have tax underpayments collected via an adjustment to your PAYE tax code, provided you are in employment or in receipt of a UK-based pension. The coding adjustment applies to certain debts such as Self-Assessment liabilities, tax credit

The Scottish rate of Income Tax (SRIT) commenced on 6 April 2016 and is administered by HMRC on behalf of the Scottish Government. The SRIT is payable on the non-savings and non-dividend income of those defined as Scottish taxpayers. This means that

The 2018-19 tax return deadline for taxpayers who continue to submit paper Self-Assessment returns is 31 October 2019. Late submission of a Self-Assessment return will become liable to a £100 late filing penalty. The penalty usually applies

If a taxpayer is self-employed and running a business from home, there are simplified expense rules available for claiming a fixed rate deduction for certain expenses where there is a mix of business and private use. The simplified expenses rules are

To calculate adjusted net income, you will need to look at a taxpayer’s total taxable income, before personal allowances, and then deduct any trading losses, gift aid donations, gross pension contributions and pension contributions where the

HMRC’s annual reconciliation of PAYE for the tax year 2018-19 is well under way. HMRC use salary and pension information to calculate if you have paid the correct amount of tax. The calculation is usually generated automatically by HMRC’s

We would like to remind any students that work part time, for example in a summer job, that they are entitled to claim back any tax overpaid. Students (and other temporary workers) are not required to pay any Income Tax if their earnings are below

The Let Property Campaign provides landlords who have undeclared income from residential property lettings in the UK or abroad with an opportunity to regularise their affairs by disclosing any outstanding liabilities, whether due to misunderstanding

The introduction of Making Tax Digital (MTD) will fundamentally change the way businesses, the self-employed and landlords interact with HMRC. The new regime will require businesses and individuals to register, file, pay and update their information

Two changes to the way Private Residence Relief works are due to come into effect from April 2020. These changes could reduce the amount of CGT relief available on the sale of a private residence. The changes are:

Home owners that let all or part

If you or your partner are a low earner or not working, then you may be eligible for the marriage allowance. The marriage allowance allows lower earning couples to share part of their personal tax-free allowance. The marriage allowance (MA) is

The P85 form should be completed by individuals or their agents to advise HMRC that have left the UK to live or are going to work abroad for at least one full tax year.

The completion of the P85 form will ensure that an individual leaving the UK

The coding threshold entitles taxpayers to have tax underpayments collected via their tax code, provided they are in employment or in receipt of a UK-based pension. The coding process applies to certain debts such as Self-Assessment liabilities, tax

The Chancellor has confirmed that from 2019-20 the personal allowance will increase to £12,500 (an increase from the current £11,850 allowance) and the basic rate limit to £37,500. As a result, the higher rate threshold will increase to £50,000 from

The First-Tier Tribunal (FTT) recently heard three joined appeals that concerned the availability of tax relief for employee expenses. In each of the cases the expense claims related to the costs incurred cleaning and sanitising working clothes

Student Loans are part of the government’s financial support package for students in higher education in the UK. They are available to help students meet their expenses while they are studying, and it is HMRC’s responsibility to collect repayments

Landlords that receive letting income should notify HMRC by 5 October after the end of the tax year for which you start to receive that income. So, for the 2017-18 tax year that has just ended, HMRC needs to be notified by 5 October 2018 of any