Funds are financial resources (money, assets) that charities can utilise to achieve their purposes.

As a trustee or a member of a charity’s management, you will need to understand the different types of funds, the role they play in how the charity operates, and common issues involved with fund accounting.

There’s a subtle difference with the disclosure of funds if you are a charity reporting on a cash basis, rather than an accruals basis. This article will predominantly consider funds from a full-SORP, accruals basis point of view. However, there is still a substantial overlap of the principles, when considering cash funds.

For more information on receipts and payments accounts, you can read our charity’s guide to receipts and payments accounts here.

Unrestricted funds

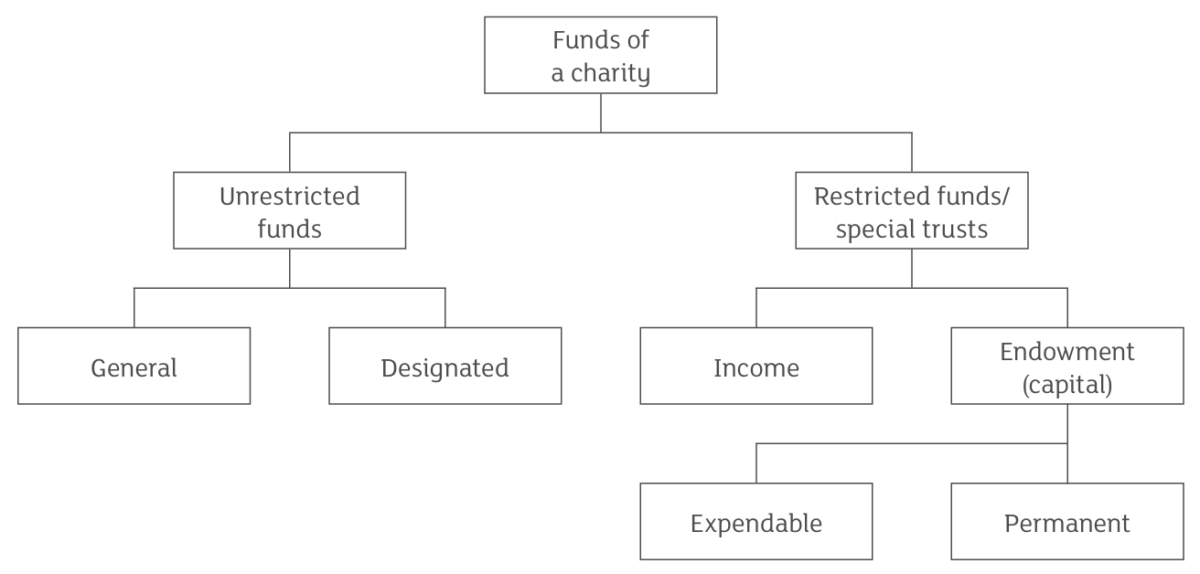

Unrestricted funds can be spent on anything within the bounds of the charity’s purposes, at the discretion of the trustees. Unrestricted funds can be split into two categories:

- Designated funds are a part of unrestricted funds that trustees can choose to set aside for specific purposes, such as an imminent project. Designated funds remain unrestricted and trustees can undesignate or redesignate these at any time.

- General funds have not been designated for a particular purpose. The free reserves of the charity are a subset of general funds.

Restricted funds

Restricted funds are held on specific trusts under charity law, which establish the purpose for which they can be used. In this case, trustees cannot restrict or derestrict funds without donor or Charity Commission permission.

The use of restricted funds is generally defined by the donor. A restricted donation is normally given with instruction to only use it on a specific purpose.

Funds might also be restricted when a charity launches a fundraising appeal for a particular project and invites donations towards that purpose.

Due to the legal inflexibility of restricted funds, potential issues can develop, such as overfunding/underfunding a project, or being tied to a certain a project, where your charity might wish to go in another direction. The wording of appeals should therefore be considered carefully to avoid creating a problem later on. The Charity Commission has released comprehensive guidance on fundraising, but you may also want to take advice to avoid any pitfalls.

Endowment funds

Endowment funds are capital in nature and used to support the long-term/future operation of the charity.

- A permanent endowment is where there is a gift of endowment, with no power to convert the capital into income. A permanent endowment fund will normally be held indefinitely. There’s no power to convert it to income, unless permission is sought from the donor or from the Charity Commission.

- An expendable endowment is a fund where the trustees have power to convert all or some of the capital fund into income, at its discretion.

Income from an endowment is regarded as revenue and is recognised as unrestricted or restricted funds, depending on the particulars of the endowment.

Fund accounting

Your Statement of Financial Activities (SoFA) must analyse income and expenditure across unrestricted, restricted, and endowment funds. Some charities find it helpful to separate designated funds in the SoFA too.

Trustees must account separately for each restricted, unrestricted, and endowment fund that they manage. Different bank accounts are not required, as long as the bookkeeping and accounts preparation is suitably defined.

When preparing year-end accounts, a note to the accounts is required, detailing the movements in each fund during the year. Funds with similar purposes can be combined for disclosure purposes. Per the SORP, the disclosure needs to be done by fund, and not by donor.

Alongside the numbers in the fund movement note, an explanation of the restriction/purpose/planned use of every disclosed fund is required.

A separate note to the accounts is also required to disclose the funds by asset type (fixed assets, cash, other net assets). This helps identify the free reserves of the charity more easily.

A key principle in preparing your charity’s accounts is transparency. The public, potential donors and regulators are keen to see that you are disclosing your funds clearly and managing them effectively.

Potential accounting issues

Here are some of the key challenges we find people face in their fund accounting…

Gift Aid misallocation: Generally, if a donation is restricted, so is the associated Gift Aid and will need to be brought into your tracking of the charity’s funds.

Donor vs. purpose: Many charities report their restricted funds by donor rather than by purpose. However, it’s much clearer for the charity to report by purpose. For example, two donors could give to the same restricted project. You could mention them both in the description, but funds with the same restriction should be reported together. Often, taking this action can help with simplifying/reducing the size of your disclosure.

Purchasing an asset with restricted funds: Once you have bought an asset, the funds have been used in-line with the restriction, and therefore the restriction is released (except in very unusual cases). You can transfer the funds relating to this asset from restricted to unrestricted funds.

Negative restricted funds: This occurs when a charity spends more on a project than they receive in restricted donations. Negative funds don’t generally occur, but they could dip negative, if you know that you are going to receive more restricted funds soon. Having negative restricted funds effectively means that unrestricted funds have been used towards that purpose too. This can be remedied by using a transfer from unrestricted funds or reducing the restricted expenditure disclosed.

Fund ownership: Occasionally, charitable organisations are given funds by another charity to hold as a custodian or agent. These are not the funds of the charity and need to be disclosed differently. Identify these custodian funds and talk to your accountant about how you should manage them.

Need some guidance?

Applying the definitions above and avoiding any issues can seem complex. Burton Sweet have encountered a great variety of situations among our charity clients. If you’re unsure on how best to manage and utilise your charity’s funds, please contact us and a member of our team will be happy to assist you.