The biggest shake-up in self-assessment for years

Back in his March 2015 budget, the Chancellor confirmed that self-assessment returns would soon be consigned to history. Their successor? Digital Tax Accounts.

Within four years, HM Revenue & Customs (HMRC) wants its relationships with taxpayers to have become almost exclusively digital, and digital tax accounts represent a significant step towards this goal. Under the new system, an organisation’s or an individual’s digital tax accounts will be accessible by them at any time from a computer, smartphone or tablet. On the surface, these accounts will supposedly look similar to an online bank account.

It will have some implications

While the prospect of ending the annual frenzied attempt to get one’s financial affairs in order may be welcome for many, others fear that the digital collection and calculation of taxes may throw up a new set of problems. All kinds of information – from the profits you might make on eBay to taxes due on dividends and income from buy-to-let properties – could soon be automatically supplied to the UK tax authority.

The current self-assessment system is described by the Treasury as “complex, costly and time-consuming”. The new system will see taxpayers log into an account and see how their tax is calculated by HMRC. This will be automatically updated throughout the year with information from employers, banks, pension providers and the Department for Work and Pensions.

The new proposal certainly seems to provide taxpayers with more choice when it comes to paying tax. Bank accounts will be linked to the tax account and tax can be paid via direct debit or instalments. This ends the prospect of a big tax demand being received often months after the end of a year, with firms and individuals instead providing information on their earnings and revenues in real time.

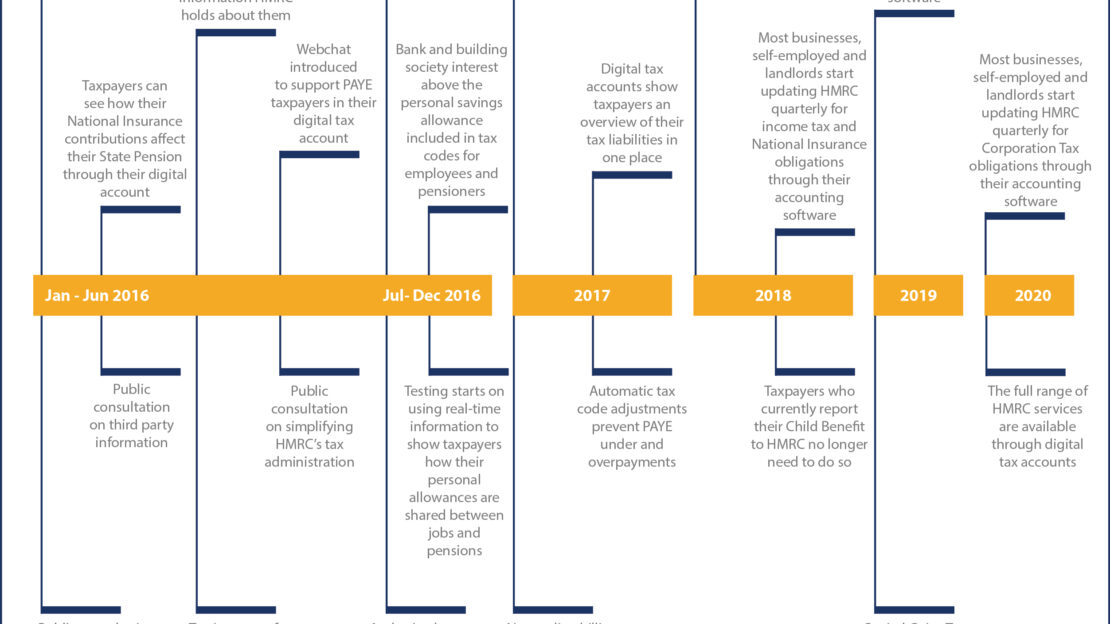

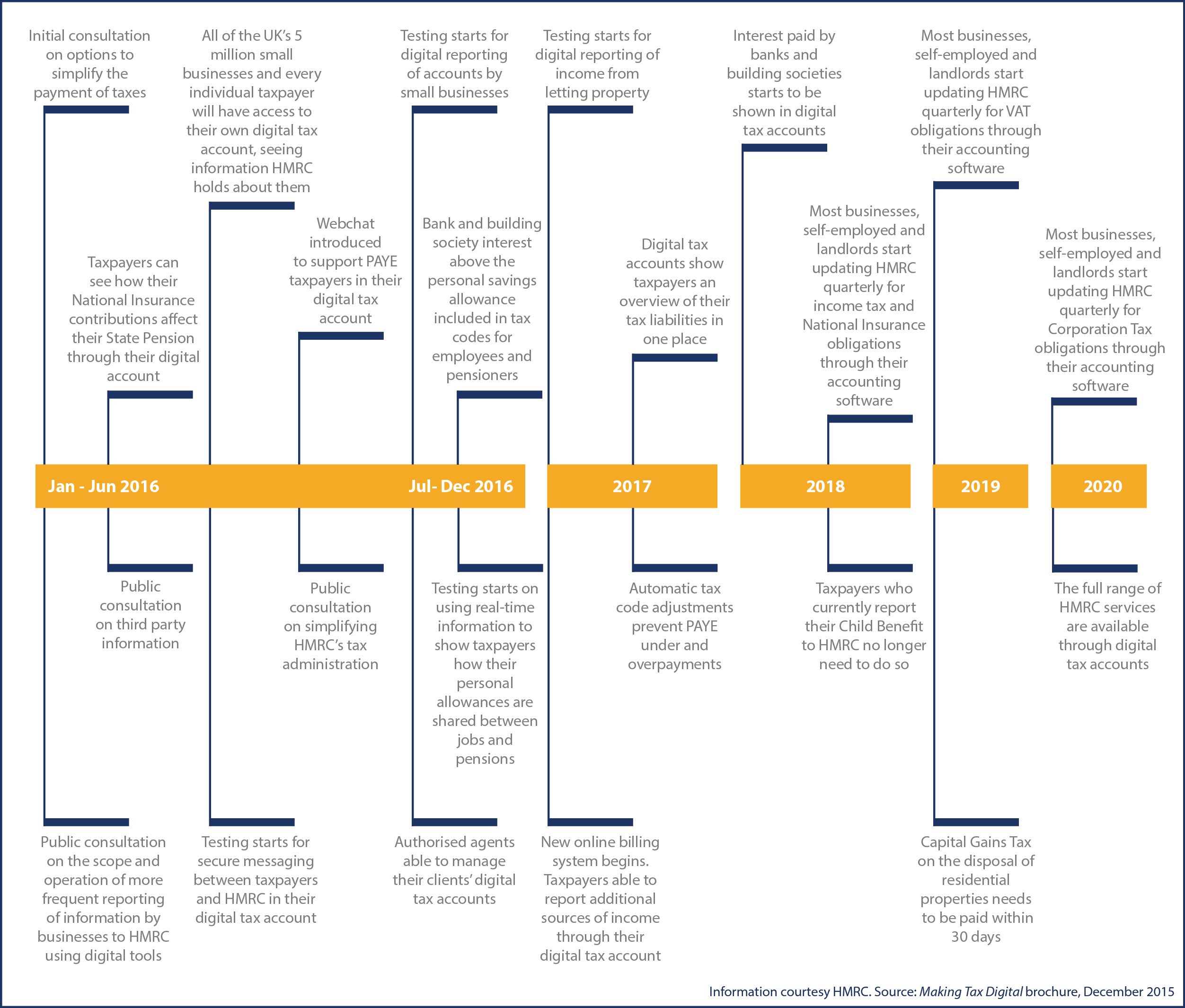

The switch-over Timeline

This year, 5 million small businesses and 10 million individuals will switch over to their own digital tax account. By May 2017, businesses will be able to register a new company and sign up for taxes in a streamlined process created jointly by HMRC and Companies House. The Treasury expects the switch away from paper returns to be completed by 2020, when “the vast majority” of Britons will have no need to fill in an annual tax return at all.

More regular submission of information

As well as having to keep track of their tax affairs digitally, there is the contentious demand that small businesses, landlords and the self-employed will have to provide more regular updates – on a quarterly, rather than annual, basis.

Despite the challenges, HMRC says personal digital tax accounts will make greater use of existing information, making life easier – not more difficult – for taxpayers. “Needlessly bureaucratic form filling will be eradicated,” David Gauke, Financial Secretary to the Treasury, has said. “I want to stress that this is the end of the tax return.”

To avoid over- and underpayments of tax during the year, HMRC says it will make greater use of ‘real-time information’, including income and benefits in kind, to make automatic tax code adjustments each month from 2017.

Where taxpayers receive irregular or one-off lumps of taxable income, they will be able to report this to HMRC online and pay any tax that arises. Making online payments would remove the need to complete a self-assessment return.

Digital Tax Accounts – in a Nutshell

Information about the new digital tax accounts system is becoming clearer as every month passes, and HMRC has already published some handy pointers to let us all start to get ready…

In short, HMRC has stated that taxpayers will be able to:

• View and manage their information online in one secure place – Taxpayers will get a real-time view of their tax affairs and see how their tax is calculated. They’ll also be able to check how much tax they owe or need to be repaid and see their options for paying securely.

• Pay the tax they owe without having to give HMRC information it already holds – HMRC will automatically use the information it holds, along with new data from third parties, to populate the digital accounts. Those who pay their tax through PAYE will have their income tax, National Insurance contributions and pension position shown in their digital tax accounts, including any interest from banks and building societies. For businesses, HMRC and Companies House will be streamlining the process to register a new company and sign up for a range of taxes by May 2017. This will remove the need for companies to provide the same information more than once.

• Link their business accounting software to their digital tax account – By 2020, businesses will be able to manage their taxes together as part of their day-to-day running, rather than something to be done separately. Their accounting software will be able to feed data straight into their digital tax account, so most businesses will simply log in to check their details with no need to send an annual return.

• Deal with their tax affairs quickly and easily – The digital tax account will show PAYE taxpayers how much tax they will pay via their employer. Even those with complex tax affairs will be able to tell HMRC about additional income online and have it reflected in their digital tax account. Individuals and small businesses will have the option to ‘pay as you go’ to help manage their cash flow, so they won’t be faced with a one-off bill many months down the line. Instead of making a number of payments across different taxes, they will be able to make just one. It will feel like paying a single tax.

• Benefit from simple, clear and personalised support – The new digital tax accounts will offer access to help and support for individuals and small businesses, increasingly tailored to their specific needs and circumstances – such as when someone approaches retirement, or when a business deals with VAT for the first time or takes on a new employee. HMRC will automatically target the right support to help taxpayers understand their overall tax position.

• Give authorised agents access to their digital tax account – Taxpayers will be able to let agents manage their digital account on their behalf if they wish. Agents will have new and different opportunities to support the small business community, and those who authorise an agent to deal with their tax affairs will see the same picture of their tax affairs online as their agent does.

• Access a wider range of government services – Over time, digital tax accounts will offer access to a range of other government services. To begin with, individuals will be able to see how their National Insurance contributions affect their state pension, while small businesses will be able to access increasingly tailored support from across government to help their business grow, via a Single Business Service.

We’re here to help and advise

The Treasury has said that the switch to digital would make lives easier for the taxpayers and companies who currently fill in an annual tax return. However, the automation of the tax system will certainly not be a substitute for the advice and assistance Burton Sweet and other accountants provide to clients.

We are committed to ensuring Burton Sweet is ahead of the changes to the self-assessment system. We will be revising many of the practices undertaken on behalf of our clients in connection with tax returns, and will be developing a whole new suite of services designed to ensure not only that their migration to digital tax accounts is as streamlined as possible, but also that their ongoing tax affairs are managed and dealt with in the most tax-efficient and cost-effective manner.

For further details of digital tax accounts and what they might mean to you, please contact Geoff Cole, Managing Partner, on 01934 620011 or email him at geoff@burton-sweet.co.uk.