From 6 April 2025, income and gains from a Furnished Holiday Let will form part of a property business, affecting tax reliefs and allowances.

There could be changes to the Capital Gains Tax system in the Autumn Budget 2024. Find out what reliefs are currently available!

For your business, a new government brings about a period of uncertainty. Consider how you can prepare to manage this transition and succeed…

Read our summary of the Spring Budget 2024, with changes to National Insurance, Child Benefit and second homes…

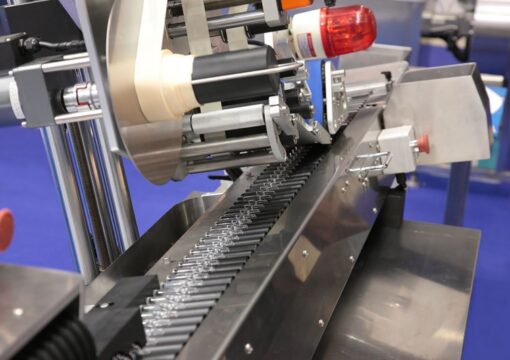

Full expensing is a 100% relief for new, eligible plant and machinery, essentially reducing its in-year cost by 25%. Businesses that invest in IT equipment and machinery will be able to claim back the cost by writing it off against tax on their profits and will be available for expenditure incurred up to 31 March 2026. This is in addition to the £1 million annual investment allowance (AIA).

There are always competing factors to consider when thinking about your March year-end as a company. How prepared do you feel?

For a round-up of what the Spring Budget contained and how this might affect you, please read our summary of some of the major changes.

In an attempt to boost the post-pandemic economy, the super deduction tax rate and special rate allowance were introduced to encourage businesses to invest and boost productivity. However, these reliefs are coming to an end…

In March 2021, when Rishi Sunak was Chancellor, the Corporation Tax rise was first announced. After some confusion that arose from the mini-budget, Jeremy Hunt has since confirmed that this rise will still take place in April 2023.

The government has confirmed that the period for which the 100% first year allowances (FYAs) are available is to be extended from April 2021 to April 2025. In tandem with this announcement, there is also a significant reduction in the CO2 emission

There is a special scheme known as the enhanced capital allowances (ECA) scheme for energy-saving technologies. The ECA scheme enables a business to claim accelerated tax relief 100% first year allowances (FYA) on qualifying energy efficient and

A UK patent is granted under the laws of the UK, usually, by the UK Intellectual Property Office. Obtaining a patent can be a difficult and expensive endeavour. A patent only protects an invention in the country where the patent is registered, and so

The recent, and temporary, increase in the AIA to £1m from 1 January 2019 creates computational issues if a trader’s accounting period straddles this date.

The following example published by HMRC illustrates one variant that you may encounter when

Capital allowances is the term used to describe the tax relief businesses can claim on certain capital expenditure and thereby reduce the amount of taxable profits. Most ‘capital’ items, such as equipment, vehicles, machinery etc last for a

The term capital allowances is used to describe the allowances available to businesses to secure tax relief for certain capital expenditure. The rules that govern the purchase of capital equipment such as computer equipment, vehicles and machinery by