5 April 2025 is the deadline to buy back missing National Insurance years, which could be significant to the State Pension you receive.

From 6 April 2025, income and gains from a Furnished Holiday Let will form part of a property business, affecting tax reliefs and allowances.

Charities did not feature significantly in the Autumn Budget 2024, but here’s a summary of some of the changes that will affect the sector…

Read our summary of some of the changes contained in the Autumn Budget 2024 and how they might affect you or your organisation…

From April 2026, reporting and paying Income Tax and Class 1A NICs on benefits-in-kind will be mandatory through payroll software.

A director can decide how much and by what means they extract the profit from their business by balancing salary and dividends.

Read our summary of the Spring Budget 2024, with changes to National Insurance, Child Benefit and second homes…

As a result of ‘administrative discrepancies’ by the Department of Work and Pensions (DWP), mothers may have been underpaid around £1bn in state pension. This has occurred due to information missing from the national insurance (NI) records.

The new tax year has begun; this means we can now submit your tax return for the year ending 5 April 2023. The final deadline may seem a way off, but submitting as early as possible is always preferable, so you are aware of any tax liabilities in good time. Here’s a checklist of things you may wish to consider.

After April 5 2025, you’ll only be able to fill National Insurance gaps going back 6 tax years, so if you have many years missing on your record, you should start considering what you can do about this.

For a round-up of what the Spring Budget contained and how this might affect you, please read our summary of some of the major changes.

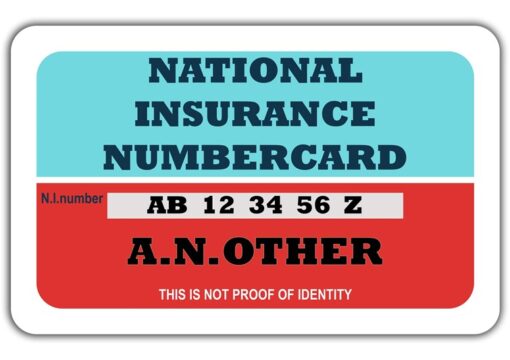

Employers use an employee’s National Insurance category letter when they run payroll to work out how much they both need to contribute. Most employees

New health and social care Levy to be introduced across the UK to provide extra cash to reform the Health and Social care systems

The Employment Allowance enables eligible employers to reduce their National Insurance liability. The maximum allowance for the 2021-22 tax year is £4,000, or your total

If you have lost or forgotten your National Insurance number you should try and locate the number on paperwork such as your tax return, payslip or P60. You can also login to your personal tax account to view, download, print, save or share a letter