Charities are subject to a range of regulatory and legal requirements designed to maintain public trust and confidence in the sector. Larger charities account for a significant portion of public money, and are therefore subject to increased external scrutiny requirements.

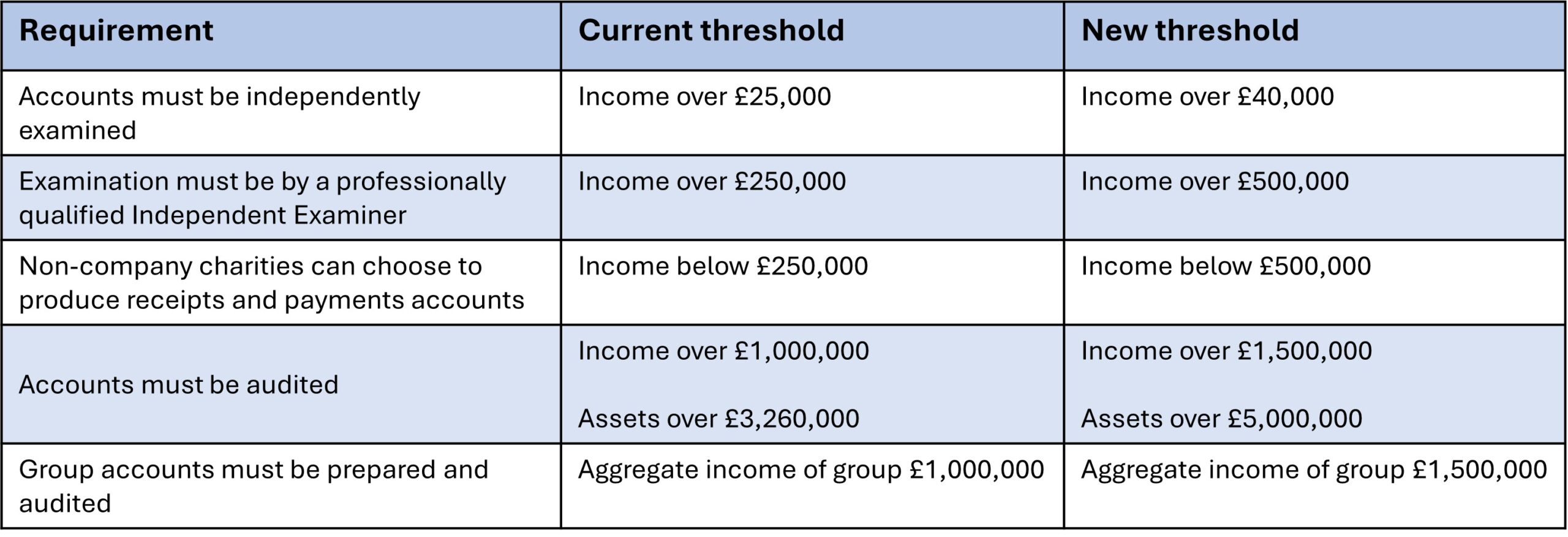

Annual reports and accounts allow the public to see how a charity is using its finances and how well it is pursuing its charitable purposes. All charities must prepare accounts, regardless of whether they are registered with the Charity Commission. However, charities surpassing certain size thresholds will need either an independent examination or audit. It’s important the thresholds are appropriately set in order to provide independent scrutiny that is proportionate to the organisation’s size and the public interest.

Following a public consultation, the Department for Culture Media and Sport has announced changes to accounting thresholds, which are expected to be in place for accounting periods ending on or after 30 September 2026.

Trustees will need to have regard to where their charity falls within the thresholds year-by-year to determine their level of disclosure and scrutiny. This should be indicated by the current trajectory of their organisation. However, the charity’s Trustees should also have regard to the charity’s governing document, which may require a level of scrutiny that is higher than the prevailing Charities Act thresholds.

Why have thresholds changed?

Some might view these changes as ‘broad brushstroke,’ to deal with economic inflation over the coming years.

It’s been ten years since the last set of changes were made. Therefore, it could be another ten years before further alterations. While some threshold changes might raise eyebrows, they may seem more appropriate or comfortable five years from now.

Additionally, company thresholds have been recently modified. Any change to company/corporate thresholds is likely to affect the not-for-profit sector too.

Need some guidance?

Burton Sweet has a longstanding commitment to charities and civil society organisations, offering practical, professional and passionate support. We want to play our part, so you can deliver effectively for the communities you serve and show the good you do.

If you want to discuss how these new thresholds might affect your charity, please contact us and a member of our team will be happy to assist you. Should you need an independent examination or audit, we provide comprehensive services in these areas.