VAT Event: Description

The Domestic Reverse Charge is going to involve a major change to invoicing and bookkeeping for many construction businesses and will impact the cash flow of many sub-contractors. Be up to date with the changes happening on 1 March 2021, join this free webinar to learn how to handle and pay VAT after these changes occur.

VAT Event: Summary

FREE webinar on Zoom from 12:00-1:00 pm on Tuesday 23rd February.

The event will be covering how the new tax changes will impact building and construction services in terms of bookkeeping, budgeting and cash flow management.

- Do you pay sub-contractors or receive payments for construction work under the Construction Industry Scheme (CIS)?

- Are you registered for VAT?

If this sounds like it’ll effect you, ask yourself these questions;

- Do you know which customers and which types of work will be affected by the new rules?

- How does the 5% disregard work?

- Do you need to leave the Flat Rate or Cash Accounting schemes (answer: probably!)?

- Is your invoicing and bookkeeping system or software ready for the change?

- Did you know that the new rules could apply to work started before 1 March?

Find out how Domestic Reverse Charge will impact your building and construction business with our team of experts.

Agenda

- Will be covering what the new changes are, how it will affect your business and practical real examples you will face after the 1st of March regarding bookkeeping and invoicing.

- How will the changes affect your cashflow?

- How to prepare your business after the changes.

- Live demonstration on how Sage, Xero, and Quickbooks will handle Reverse Charge transactions.

- How to keep VAT records using automated software.

- How to keep VAT records manually with excel type tables.

Questions & Answers

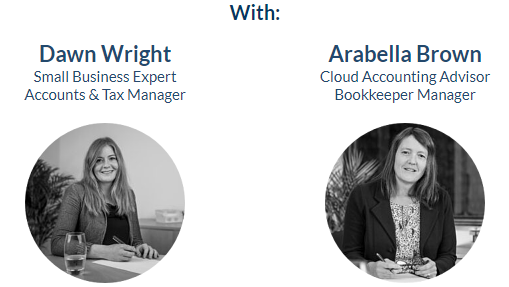

Live questions and answers section at the end of the presentation, this will be a chance to get your questions answered by Burton Sweet Accounts & Tax Manager, and Bookkeeper & cloud accounting Manager with any questions relating to VAT Domestic Reverse Charge changes and how we can help your business forecast, budget and plan ahead.

Everyone who books will receive a copy of the slides and notes, and a link to a recording of the webinar afterwards to use for future reference.