Submitting a self-assessment tax return is an activity some dislike. Getting all the relevant details together can seem complex, particularly if, for one reason or another, they haven’t been keeping on top of them throughout the year. As well as this, others do not, or cannot, pay their taxes in time.

These situations can induce stress, and worse, penalties from HMRC. People miss the deadlines for all kinds of reasons, some of which they can’t control. If you think this could be the case for you, it’s important you’re prepared in advance.

This article outlines the relevant dates and potential penalties, alongside options you could take if you can’t meet these deadlines.

Deadlines

The deadline for submitting an online self-assessment tax return is midnight 31 January 2024. This is also the deadline to pay any tax you owe from the previous year.

A second payment deadline, 31 July 2024, could apply if you make advance payments on account towards your bill.

If you cannot pay your tax bill, or cannot sufficiently submit your return, you should contact HMRC as soon as possible and consult your accountant (if you have one) on how best to proceed.

Penalties

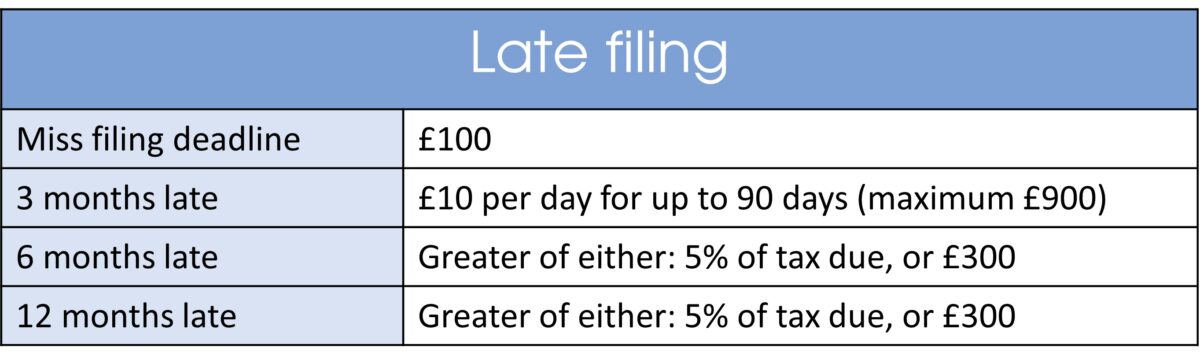

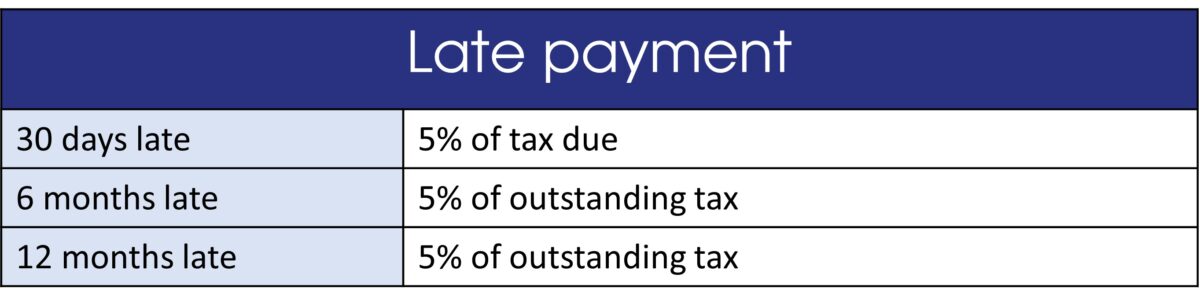

Failing to meet a deadline is never desirable. However, in certain situations people are left without choice. If you miss the either the deadline for submitting your self-assessment tax return, or for paying tax, you will receive a penalty in the form of surcharges and/or interest.

You can appeal against penalties if you have a reasonable excuse.

The current late payment interest rate (from 22 August 2023) is 7.75%. This may change to match the Bank of England base rate.

Estimate the potential penalties you could incur using the GOV.UK calculator.

Time to Pay arrangements

You might be able to pay your tax bill in instalments, should you be incapable of paying it in full.

These monthly payments would be based on your income and expenditure. So, HMRC would look at what you can afford to pay, as well as the time needed to clear the entire debt. Your current income, disposable assets and expenditure would be used to determine this. Time to Pay arrangements are based on the specific financial circumstances; consequently, there is no ‘standard’ format for these scenarios.

HMRC says:

‘The arrangement is designed to be flexible and is not a fixed, formal contract. It can be amended over time, so it can be shortened if your earnings rise or if you) receive a cash windfall (for example, an inheritance). It can also be lengthened if your essential expenses increase, or your income reduces.’

(Source: How to pay a debt to HMRC with a Time to Pay arrangement)

Generally, HMRC does not expect people to pay more than 50% of their disposable income as part of these arrangements, unless your disposable income is high. There is no upper limit on the amount of time that someone can have to pay.

For self-assessment bills, you can set up a plan online, where you can pay instalments, without contacting HMRC. This can only be achieved if:

- you owe £30,000 or less

- you do not have any other payment plans/debts with HMRC

- your tax returns are up-to-date

- it’s less than 60 days after the payment deadline

As with all other cases in this article, contact HMRC as soon as possible if you think a Time to Pay arrangement will be necessary for you. Even if you are a Burton Sweet client, this is not something that we can do for you.

Need some guidance?

If you’re unsure about submitting your self-assessment tax return, whether you can meet the payment deadline, or if will be able to afford your tax bill, please get in touch with Burton Sweet, a member of our team will be happy to assist you.

Get ahead of the game, so you can make completing these tasks as stress free as possible.