With the increases in inflation and the cost-of-living, you will have noticed that the prices of goods and services has risen in both your personal and professional lives.

Have you increased the value of your goods, supplies or labour, to maintain your profit margins?

If so, and you are not already registered for VAT, you will need to keep a close eye on your turnover. You might go over the VAT threshold without realising it.

The taxable turnover threshold that makes it compulsory to register for VAT has not been increased since 2017, standing at £85,000. There are no proposals to change this any time soon.

Generally, the £85,000 is the amount of goods sold/income earned in a 12-month period. More precisely, taxable turnover includes standard and zero-rated supplies but not exempt supplies. The period is not an accounting year, but a rolling 12-month period.

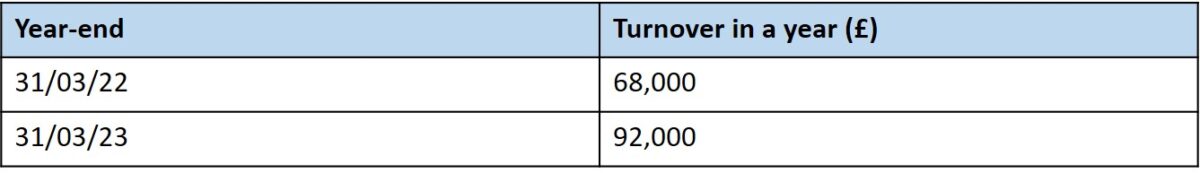

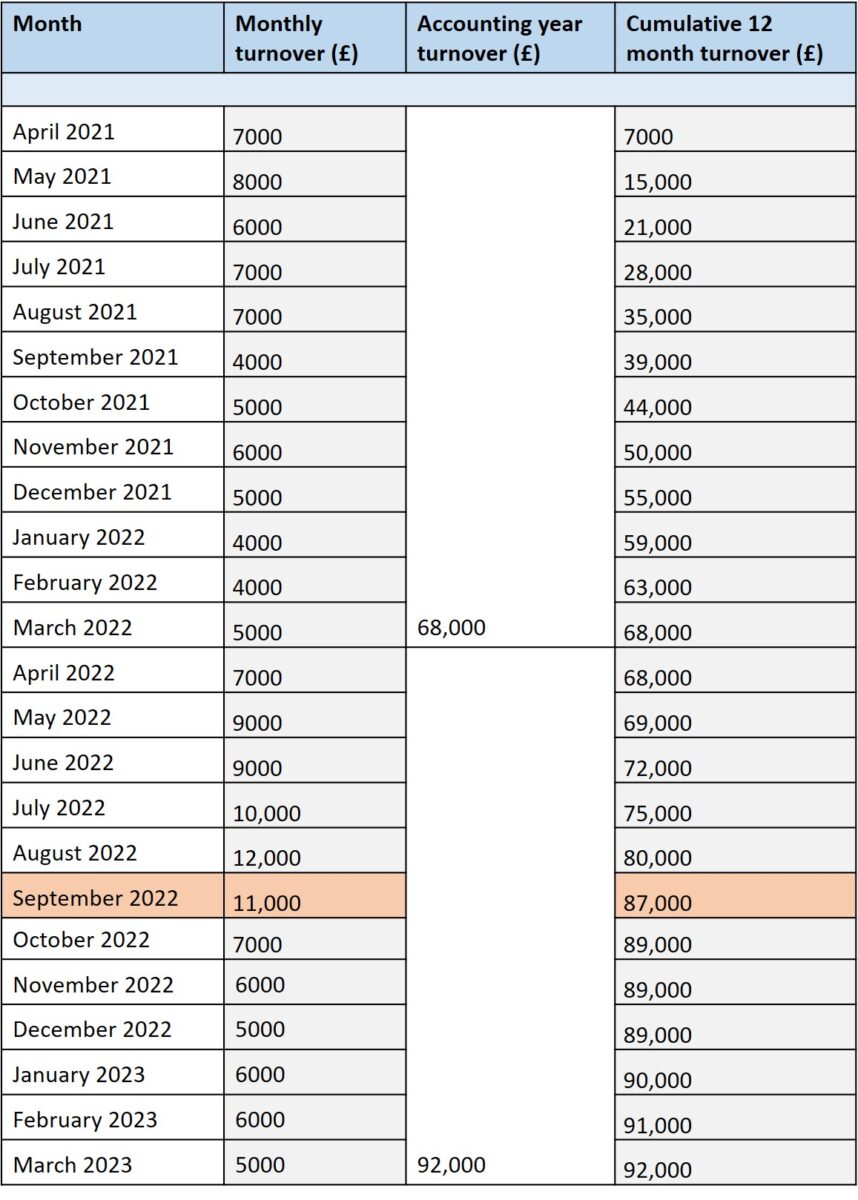

Example:

The VAT threshold was not exceeded at 31 March 2022, but somewhere between this date and 31 March 2023.

Registration must be done within 30 days of exceeding the threshold. Therefore, each month needs to be looked at on a month-by-month basis and a rolling cumulative total must be calculated to work out the exact point of registration.

From the example above, the threshold was breached in September 2022, when the 12 months income on a rolling basis became £87,000.

In this case, they would have until 30 October 2022 to register for VAT, becoming VAT registered from 1 November 2022.

Note that there is another threshold that can be passed. This is if you know that you will have taxable turnover above £85,000 in the next 30 days. It’s a 30-day period from realising that the threshold will be passed, to registration.

Registration needs to be carried out online with HMRC, who will provide you with a VAT number. Once you have received this, you will need to charge VAT on your taxable supplies.

You will also be able to recover the VAT that is added to the costs of most, if not all, of your purchases.

Alongside statutory registration, there is also the option of voluntary registration. For some businesses, registration can be useful.

If you are getting close to the VAT registration threshold, or would otherwise consider registration, please do get in touch with Alison for further advice…