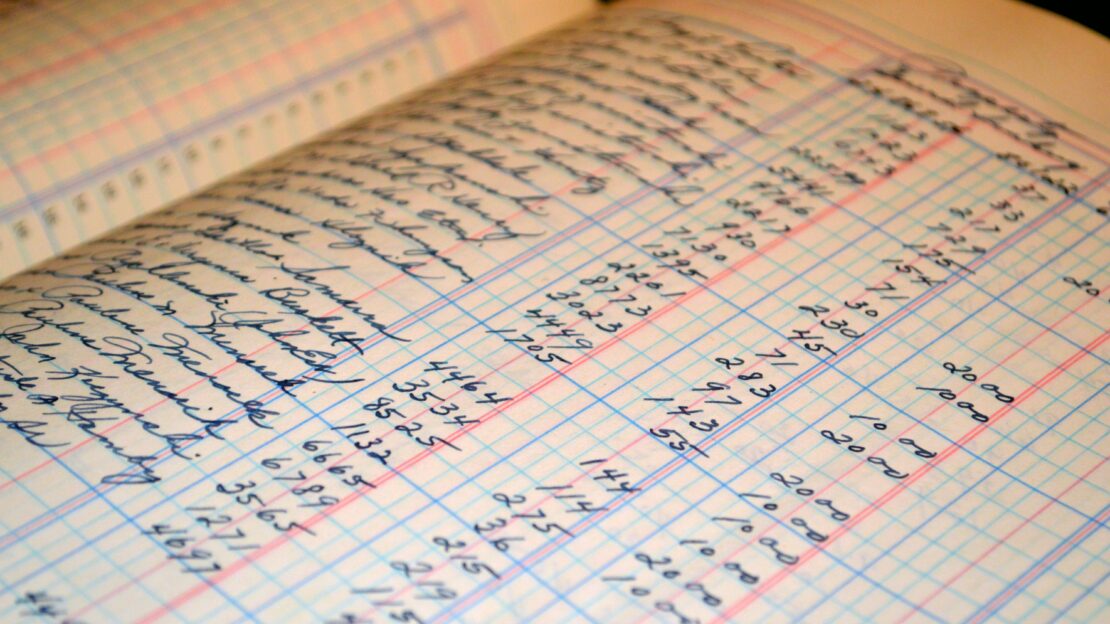

For businesses, closing the year-end involves reviewing and reconciling their figures, ensuring all financial transactions are included and are supported by the relevant records.

For accountants, finalising the year-end includes diligently checking their clients’ financial information and paperwork (digital or not) and preparing financial statements. This involves careful attention to detail, and where necessary, requesting missing information.

Conducting year-end work can be difficult to prioritise, with the day-to-day stresses of the business, alongside the work required to finalise your financial records.

However, there are a number of key strategies that can make your year-end process a more seamless activity for both parties.

The important details

The tax year for personal tax runs from 6 April to 5 April the following year. Many unincorporated businesses also use this date for their accounting year, so they’re working towards the same deadline. Other organisations opt for another date for their business year-end, with many finding it convenient to use 31 March, whilst some follow the calendar year.

If you are a sole trader, unincorporated partnership, or limited liability partnership and have a year-end that is not 31 March or 5 April, the way in which HMRC assesses your profits will be changing. Read our full article on this here.

At year-end, it’s important you provide the correct details to HMRC and Companies House (if applicable), declaring your tax liabilities and presenting information about your company.

Companies must submit:

Statutory annual accounts

The financial statements must be sent to Companies House. The accounts clearly and consistently outline your company’s financial activity in that year and position at the year-end for the benefit of the public.

Company tax return (CT600)

This return contains information about the company’s turnover, expenditure, tax allowances and profit. The figures are supported by the company’s attached statutory accounts. These details are used by HMRC to calculate corporation tax owed.

VAT

It’s worth noting that if you need to submit VAT returns, one of the company’s submissions may also be due at your financial year-end. Consequently, it makes sense to gather the information for the VAT return alongside your other reporting activities.

10 top tips

If you want to make your year-end processes as simple as possible, we suggest you consider the following actions:

1) Stay on top of the accounting records throughout the year. If you are able to do this, it will make the year-end far easier. Although this is the best strategy, we recognise that this is not going to be possible for everyone, an alternative is planning for the year-end well in advance, so you have the space and resources to complete the necessary work.

2) Accounting software offers a more accurate and efficient way to collect and collate data, including banking, invoicing, budgeting and maintaining ledgers. It isn’t a magic bullet, but using software correctly will reduce the chance of errors further down the line. For some businesses this will already be a requirement due to Making Tax Digital, which are also on the horizon for others. If you would like to take-up a software option, such as QuickBooks Online or Xero, then do let us know as we may be able to offer a discount, training and setup.

3) Know who owes your business money; send an invoice, statement or reminder to try to claw it in before the year-end for a better cash position and more certain asset. Understand who your business owes money to. There are some benefits to paying off creditors, however generally speaking stay within the terms of your credit to maximise goodwill with your suppliers and cashflow.

4) Reconcile your bank accounts. Ensure your bank statements match your accounting records, with any outstanding payments or receipts understood. This is the first step to ensuring that your year-end figures are correct. Software can be very helpful here with some solutions offering automatic bank statement downloads and feed. Collect the year-end statements to send to your accountants.

5) Reconcile business loans, so your loan balances match what’s recorded in the financial statements. Check that the interest expense has been recorded correctly. Collect the year-end loan statements to send to your accountants.

6) If relevant, conduct a stock/inventory count. Complete a reconciliation between the physical items and your records of what you hold. The value of the inventory can be calculated a couple of different ways, one being based on purchase price on a first-in-first-out basis (FIFO). Once you know the value of the stock, ensure that it is held at this value in the balance sheet. Work-in-progress is a similar area that can be calculated in a systematic way to give the right asset on the balance sheet.

7) Review your balance sheet. Your balance sheet is made up of the company’s assets and liabilities. It is fairly common for some past assets or liabilities to be irrelevant and will consequently need adjustment. If you do not understand what an item is, it’s unlikely that your accountant will either!

8) Once you are happy with the balance sheet, you can start looking at the profit and loss. Before jumping to the overall profit, review the profit and loss codes/areas looking for transactions that are in the wrong place or for totals that look unexpected.

9) Once you are comfortable with the profit and loss, it would be a good exercise to set your expectations for any tax liability. Corporation tax is due 9 months after the year-end and the tax return is due 12 months after the year-end. At a simple level there are usually some allowances available or disallowable expenditure. As you dig deeper, there could be losses, gift aid relief, research and development relief. For a rough estimate, you could look at the tax charge of a past year with a similar profit.

10) Update your employee data. Payroll is not simple. Even if you outsource your payroll, ensuring that employee files are up to date with contracts on file, letters confirming salary or condition changes and holiday allowances (which can lead to an accrual) is recommended. Ensure that employees who claim expenses bring the claims in swiftly after the year-end, as it will likely relate to the year.

Need some guidance?

If you have any queries or are concerned about managing your year-end process, please get in touch with us and a member of our team will be happy to assist you.

Give your figures a boost

We find that business owners benefit from better data about their businesses. To make the best decisions, you need good information. If there are elements of your accounts or management information that are inhibiting your organisation’s performance then you may benefit from an upgrade in your bookkeeping, accounting or financial outsourcing support. Have a look at what we offer in these areas here.