From 6 April 2025, income and gains from a Furnished Holiday Let will form part of a property business, affecting tax reliefs and allowances.

There is a new scam letter targeting businesses, requesting taxpayers ‘verify’ their financial information via email.

HMRC has launched a quick digital tool, so businesses can estimate how registering for VAT might affect them.

This article covers the important considerations in setting-up and running a trading subsidiary to raise money for your charitable work.

Read our summary of the Spring Budget 2024, with changes to National Insurance, Child Benefit and second homes…

Conducting year-end work can be difficult to prioritise. Read through our ten strategies that can make your year-end process a more seamless.

Have you increased the value of your goods, supplies or labour, to maintain your profit margins? If so, and you are not already registered for VAT, you will need to keep a close eye on your turnover. You might go over the VAT threshold without realising it.

For a round-up of what the Spring Budget contained and how this might affect you, please read our summary of some of the major changes.

If not, but you are voluntarily registered for VAT because your annual turnover is below £85,000, you will need to sign up for MTD

Currently, VAT registered businesses with a taxable turnover of more than £85,000 must follow the rules for ‘Making Tax Digital for VAT’ (MTD) by

The rules for deciding whether a gift given in the course of business is deductible are complex. The rules for business gifts generally follow

Maybe – maybe not! In certain circumstances special ‘transfer of a business as a going concern’ (TOGC) rules apply and the sale will not

For most fully taxable businesses, VAT can be reclaimed on goods and services used in the business. This means that businesses must consider where

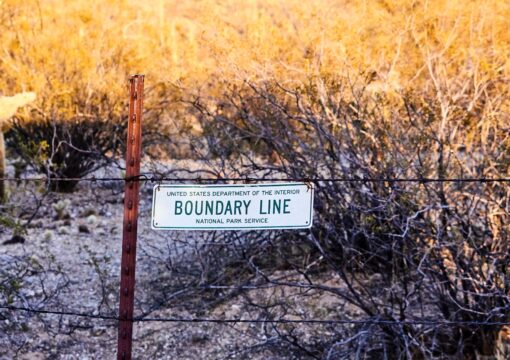

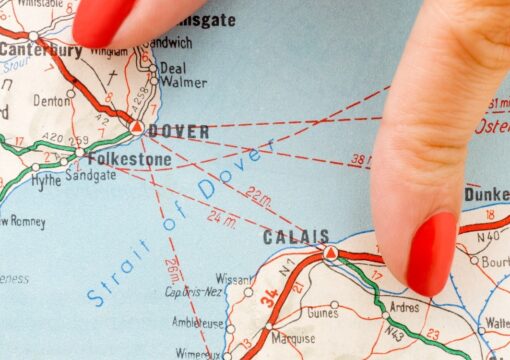

It is well over a month since the implementation of a full border between the UK and the EU. Because of the pandemic, trade

INTRODUCTION New VAT rules are due to come into effect from March 2021 which will impact on accounting for VAT for transactions in the