Maybe – maybe not! In certain circumstances special ‘transfer of a business as a going concern’ (TOGC) rules apply and the sale will not

Having listened to stakeholder feedback from businesses and the accounting profession, the government have announced that they will introduce Making Tax Digital (MTD) for

The assessment of self-employed or partnerships profits is usually relatively straight-forward if the accounting date – the date to which accounts are prepared – falls between 31 March and 5 April. However, overlap profits can arise where a business

Would you like someone to take care of your company’s day-to-day financial challenges? Running a business can be complex enough without the additional concern

Have you ever been pushed into buying something that you really didn’t want? Most of us have. Maybe it was a salesperson over the

New health and social care Levy to be introduced across the UK to provide extra cash to reform the Health and Social care systems

New businesses may come and go, but cash flow ultimately determines whether or not a business will be running long enough to see it

Tiered and Volume Pricing models are often used interchangeably and look deceptively similar. However, both apply where customers buy quantities of the same items.

Business gurus will tell you that there are 5 or 6 – or maybe even 8 – ways to increase your profits. Whatever the

As business advisors, we often ask prospects and clients who their target market is. One answer that comes up from time to time up

There is a well-known saying that’s proven to be true time and time again: “You need to spend money to make money.” But it

We looked at how you might calculate your selling prices in our article under the Improving Profit Margins pillar. In this article, we’re looking

Do you want total confidence in your finances to help push your company forward? Why have a financial controller? Burton Sweet provide a financial

For most fully taxable businesses, VAT can be reclaimed on goods and services used in the business. This means that businesses must consider where

You may recall that a new Plastic Packaging Tax was announced in the 2020 Budget. The legislation is now before Parliament so we have

What is a multi-year contract? It’s simply a contract with your customer that lasts longer than one year and gives you both some financial

The success and long-term value of any business depend heavily on the relationships it builds with its customers. Therefore, your company’s most valuable asset

The Employment Allowance enables eligible employers to reduce their National Insurance liability. The maximum allowance for the 2021-22 tax year is £4,000, or your total

The trivial benefits in kind (BiK) exemption applies to small non-cash benefits like a bottle of wine or a bouquet of flowers given occasionally

As part of its “Plan for Jobs”, the government has now announced that, from 1 June 2021, employers of all sizes in England can

6th April marks the start of the new tax year for us in the UK. But have you ever wondered why we picked such

You can now find the key tax rates and allowances which will be affect our business and personal lives in 2021/22 – just click

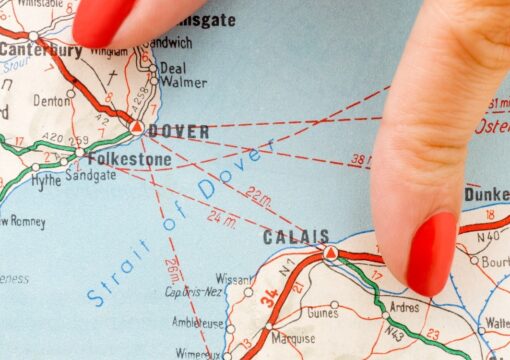

It is well over a month since the implementation of a full border between the UK and the EU. Because of the pandemic, trade

INTRODUCTION New VAT rules are due to come into effect from March 2021 which will impact on accounting for VAT for transactions in the