Find out what changes have been made to the Inheritance Tax regime for agricultural and business property from 6 April 2026.

Charities must be aware of the relevant legal and tax rules that apply to making payments overseas and supporting causes abroad.

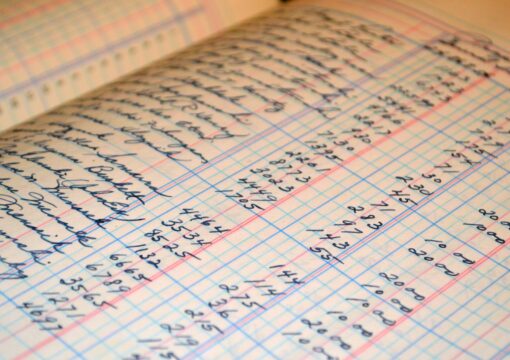

This article will cover some profit and loss statement basics, as well as exploring what this information can tell you…

From 6 April 2026, people with trading/property income over £50,000 per annum must keep records and report information digitally to HMRC.

Charities did not feature significantly in the Autumn Budget 2024, but here’s a summary of some of the changes that will affect the sector…

If you’re starting a new business, it’s vital you understand the financial and legal pros and cons the different structures offer.

There is a new scam letter targeting businesses, requesting taxpayers ‘verify’ their financial information via email.

HMRC has launched a quick digital tool, so businesses can estimate how registering for VAT might affect them.

The King’s Speech focused strongly on creating a stable economic environment, but what will this practically mean for businesses?

For your business, a new government brings about a period of uncertainty. Consider how you can prepare to manage this transition and succeed…

Conducting year-end work can be difficult to prioritise. Read through our ten strategies that can make your year-end process a more seamless.

From January 2025, digital platforms such as eBay, Airbnb, Etsy and Vinted will have to routinely collect and report sellers’ income to HMRC.

These are relevant dates and potential penalties for self-assessment returns, alongside possible options if you can’t meet the deadlines.

The new tax year has begun; this means we can now submit your tax return for the year ending 5 April 2023. The final deadline may seem a way off, but submitting as early as possible is always preferable, so you are aware of any tax liabilities in good time. Here’s a checklist of things you may wish to consider.

There are always competing factors to consider when thinking about your March year-end as a company. How prepared do you feel?