Maybe – maybe not! In certain circumstances special ‘transfer of a business as a going concern’ (TOGC) rules apply and the sale will not

Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension.

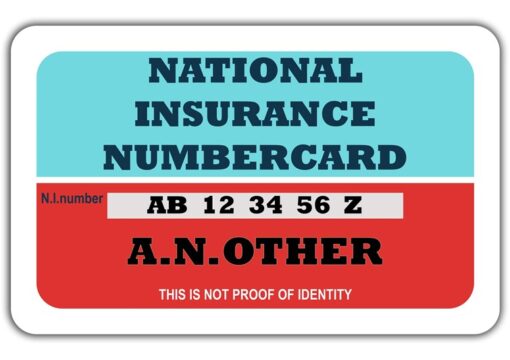

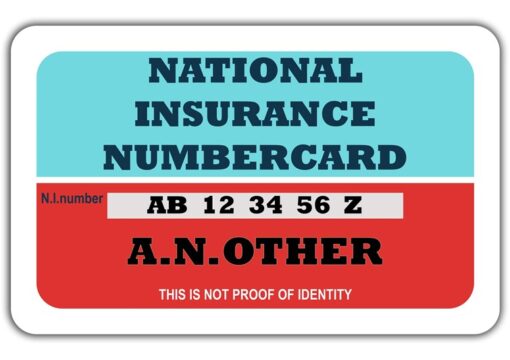

Employers use an employee’s National Insurance category letter when they run payroll to work out how much they both need to contribute. Most employees

Having listened to stakeholder feedback from businesses and the accounting profession, the government have announced that they will introduce Making Tax Digital (MTD) for

The assessment of self-employed or partnerships profits is usually relatively straight-forward if the accounting date – the date to which accounts are prepared – falls between 31 March and 5 April. However, overlap profits can arise where a business

Would you like someone to take care of your company’s day-to-day financial challenges? Running a business can be complex enough without the additional concern

Have you ever been pushed into buying something that you really didn’t want? Most of us have. Maybe it was a salesperson over the

New health and social care Levy to be introduced across the UK to provide extra cash to reform the Health and Social care systems

New businesses may come and go, but cash flow ultimately determines whether or not a business will be running long enough to see it

Tiered and Volume Pricing models are often used interchangeably and look deceptively similar. However, both apply where customers buy quantities of the same items.

Business gurus will tell you that there are 5 or 6 – or maybe even 8 – ways to increase your profits. Whatever the

As the result of recent increases in petrol and diesel prices, HMRC has increased the advisory fuel rates that apply for the reimbursement of